Sign Up Today!

-

Latest News

- Blick Law Firm Works Closely with Tampa’s Chiropractic and Acupuncture Clinic

- Blick Law Firm Brings Legal Expertise and Christian Values to Tampa

- What can a personal injury attorney do for you?

- The Importance of a Real Estate Attorney in a New Transaction

- Over 150 New Florida Laws Take Effect this Month

- Law Change Protects Florida Patients From Balance Billing

- Fatal Alligator Attack at Disney World Orlando Could Mean Legal Trouble

- Florida Gun Laws Under Fire After Orlando Attacks

- Prospect of Medical Marijuana in Florida Creates Buzz

- Florida’s Death Penalty System Subject to Further Questioning

- Summer Driving Safety Tips

- Florida Supreme Court Votes to Maintain Reasonableness in Workers’ Compensation Law

Tags

abogado cristiano abogado de lesiones personales abogado en tampa abogados abogados en tampa abogados real estate abogados tampa accident attorney accident attorneys attorney for the defense attorneys in tampa auto accident bancarotta en tampa bankruptcy attorney blick law firm carrollwood carrollwood attorney carrollwood businesses carrollwood law firm carrollwood real estate christian attorney christian law association christian law firm christian lawyer christian lawyers christian lawyers association christian lawyer tampa driving under the influence helping the hurting michael c blickensderfer military lawyer military lawyers minute with mike personal injury personal injury attorney personal injury attorneys personal injury lawyer personal injury lawyers real estate law tampa attorney tampa law firm tampa personal injury attorney tampa real estate attorney veterans veterans lawyer

Category Archives: Bankruptcy

Post-Foreclosure| Deficiency Payments Running Amok

Written By: Louie Talacay

Nausea, sleep-deprivation, stress, anxiety, hypertension, headache and depression: one might believe that someone suffering from these conditions is severely ill, but these are actually symptoms of an unexpected deficiency payment.

Nausea, sleep-deprivation, stress, anxiety, hypertension, headache and depression: one might believe that someone suffering from these conditions is severely ill, but these are actually symptoms of an unexpected deficiency payment.

The deficiency sneaks up on them like a phantom from the past. It stalks the borrower years after they have forgotten about their abandoned home and strikes only after they’ve seemingly gotten back on the road to financial stability.

It’s a vicious cycle that never seems to end. Borrowers struggling to recover from financial distress stand up only to be knocked down again. They endure a terrifying maelstrom, seeing the break in the clouds only to realize that they are just in the eye of the storm.

Many larger lenders are now seeking deficiency payments from foreclosed borrowers. What was once an uncommon practice now seems to be commonplace, especially with the federal lending giant Fannie Mae. The surge of deficiency suits have grown exponentially like bacteria festering when times are opportune. Regulations in some states have limited the timeframe in which banks can seek deficiencies. The resultant has been the creation of debt collection factories that mimic the expansive foreclosure mills which steamrolled homeowners out of their homes and livelihoods.

Well hold your horses Fannie Mae! Borrowers are wising up and seeking counsel. They are being meticulous and weighing their options. They won’t be taken advantage of any longer. For borrowers that have been unscrupulously served a deficiency payment the following options are available:

1. Seek out a lawyer for general counsel and advice

2. Hire a lawyer to negotiate a settlement and take care of that debt once and for all

3. Take the lender or the debt collector to court for unfair and unjust practices

4. Bang the gavel and say sayonara to any deficiencies by filing for bankruptcy

Be aware of your options and don’t be victimized again. Seek counsel with an attorney that is familiar with debt collection practices at our office today and get a free consultation with an Tampa Bay attorney over 25 years!

Related Articles: http://www.reuters.com/article/2014/10/14/us-usa-housing-foreclosures-insight-idUSKCN0I30BU20141014

Posted in Bankruptcy, Blog, Foreclosure Defense, Real Estate

Leave a comment

Joint Filing | Bankruptcy Chapter 7

If you are a married couple and considering filing Chapter 7 Bankruptcy there questions that may arise such as: determining whether to file jointly or individually. This determination is very critical to the outcome of your filing and you should address this with a Bankruptcy attorney before proceeding.

If you are a married couple and considering filing Chapter 7 Bankruptcy there questions that may arise such as: determining whether to file jointly or individually. This determination is very critical to the outcome of your filing and you should address this with a Bankruptcy attorney before proceeding.

In some cases, one spouse may have the majority of debts or all debts and deem it necessary to file a bankruptcy separate from the other spouse. However, in cases where both spouses are facing financial hardship in meeting the payments on their debt it may be advantageous to file Bankruptcy jointly.

Advantages to filing jointly/together include:

- Filing jointly is more efficient by consolidating the filing, making it is less time consuming

- Paying only one filing fee instead of paying the same fee twice for separate filings

- Assistance from the other spouse in gathering all the necessary documentation together, which can be extremely burdensome

Joint filing, however, may have disadvantages as well especially when there is a large disparity in the debts and assets between the spouses. Call your bankruptcy attorney to determine what is most effective and beneficial filing for you and your loved one.

If you do not have an attorney and have concerns about your Bankruptcy or are considering filing Bankruptcy jointly, call Blick Law Firm today and schedule a free 15-minute consultation with attorney Michael Blickensderfer. Think quick, call Blick!

Posted in Bankruptcy, Blog

Leave a comment

Tampa Law Firm’s mission for “Helping the Hurting”

Blick Law Firm seeks to meet the legal needs of our clients, as well as provide emotional support to those in need. We are a Christian-based law firm that is grounded in Christian values. You can view more of our beliefs and core values on our website by visiting: blicklawfirm.com/about/

Blick Law Firm seeks to meet the legal needs of our clients, as well as provide emotional support to those in need. We are a Christian-based law firm that is grounded in Christian values. You can view more of our beliefs and core values on our website by visiting: blicklawfirm.com/about/

Our beautiful location and Tampa Bay Law Firm is located at 3812 Gunn Highway Tampa, FL 33618. Our headquarters offers a wide variety of legal services including:

Personal injury

Areas of personal injury representation include: automobile accidents, motorcycle accidents, premises liability, dog bites, slip and falls, marine and boating accidents, wrongful deaths and medical malpractice.

We have over 25+ legal experience to help our clients seek justice against insurance companies in any injury claim. Call us today to ask about or free case evaluation! No attorney fees, unless you win!

Criminal law

Blick Law firm offers legal representation in criminal law specifically in the areas of: Driving under the influence (DUI/DWI), traffic infractions, HTO, criminal defense, white collar crime, and sealing record removal. Attorney Michael Blickensderfer has extensive knowledge in white collar crime defense and medicaid/medicare fraud. Call today to seek your consultation with the top Criminal Defense legal firm!

Immigration

Blick Law Firm works with those seeking proper guidance to receive United States citizenship. Our firm offers immigration service including: visa, asylum, citizenship, naturalization, deportation defense, adjustment of status, and employment authorization.

Bankruptcy

If you are overwhelmed with debt, filing for chapter 7 bankruptcy may offer you protection and relief from your financial hardship. Our law firm can help make sure that your claim is successful; properly and legally filed; and can answer any questions you may have regarding your bankruptcy claim and how the process works. Additionally, our firm offers courses on life after bankruptcy and credit repair. Contact us today if you are interested to hear more about our variety of deft relief services.

Real Estate | Title Insurance

Blick Law firm’s real estate and title insurance company can aid you in foreclosure defense, title insurance, loan modifications, and short sale negotiations. We work with commercial and residential properties all across the state of Florida; and have a seamless paperless closing process for all our clients. To know more about our title services visit: www.infinityabstracttitle.com.

If we can help you in any of these areas please give us a call at 888-973-2776, or come in for a free consultation with attorney Michael C. Blickensderfer. Think Quick, Call Blick!

Bankruptcy: Chapter 7 and 13

Bankruptcy cases are gen erally filed under Chapter 7 or Chapter 13 of the Bankruptcy Code. Filing for bankruptcy can be very intimidating and confusing for most people. When filing for bankruptcy, it is very important that the information and paperwork are filed correctly to ensure that your bankruptcy claim is successful. An experienced bankruptcy lawyer can assist you with your bankruptcy claim, and help to make sure that the proper steps and precautions are being made when filing.

erally filed under Chapter 7 or Chapter 13 of the Bankruptcy Code. Filing for bankruptcy can be very intimidating and confusing for most people. When filing for bankruptcy, it is very important that the information and paperwork are filed correctly to ensure that your bankruptcy claim is successful. An experienced bankruptcy lawyer can assist you with your bankruptcy claim, and help to make sure that the proper steps and precautions are being made when filing.

Chapter 7

Chapter 7 of the bankruptcy code is used to liquidate assets so that debts can be paid. This option allows those struggling with debt to obtain a fresh start and new financial beginning. Repayment plans are also available to get those struggling with debt back on track.

Chapter 13

Unlike Chapter 7, Chapter 13 of the bankruptcy code does not involve the liquidation of assets. Chapter 13 allows the debtor to keep property and negotiate bills so that they can be consolidated. This method of bankruptcy requires more time than that of chapter 7 due to the repayment process. The repayment plan allows those struggling with debt to keep their assets as, well as pay off their bills.

Filing for Bankruptcy can be a very time consuming process, and it is crucial that paperwork is filed correctly. Assistance from an experienced Bankruptcy Lawyer is highly recommended when considering filing for Bankruptcy. An experienced Bankruptcy attorney can provide you with detailed information regarding your options, as well as assist you with the execution of your claim. A Bankruptcy Lawyer can also help to make sure that your paperwork is properly filed and completed, as well as assist you with any discrepancies that may arise.

considering filing for Bankruptcy. An experienced Bankruptcy attorney can provide you with detailed information regarding your options, as well as assist you with the execution of your claim. A Bankruptcy Lawyer can also help to make sure that your paperwork is properly filed and completed, as well as assist you with any discrepancies that may arise.

If you are considering Bankruptcy, the experienced lawyers at Blick Law Firm can help to secure your benefits and maximize your recovery. Call Blick Law Firm today for a free 15 minute consultation.

Posted in Bankruptcy, Blog

Leave a comment

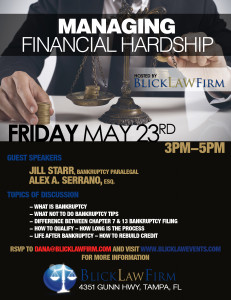

Blick Law Firm Managing Financial Hardship Seminar

Blick Law Firm is hosting a free “Managing Financial Hardship” seminar on Friday, May 23rd from3 to 5pm. The seminar will be held at Blick Law Firm’s previous office at 4351 Gunn Highway in Tampa. Bankruptcy Paralegal Jill Starr, and Attorney Alex A. Serrano will be discussing some options available to those facing financial hardship. In depth information in regards to what bankruptcy is will be discussed, as well as how it can be useful, and the distinctions between chapter 7 and 13. Information concerning what not to do preceding and during your bankruptcy case will also be explained, along with a “life after bankruptcy” session.

Blick Law Firm is hosting a free “Managing Financial Hardship” seminar on Friday, May 23rd from3 to 5pm. The seminar will be held at Blick Law Firm’s previous office at 4351 Gunn Highway in Tampa. Bankruptcy Paralegal Jill Starr, and Attorney Alex A. Serrano will be discussing some options available to those facing financial hardship. In depth information in regards to what bankruptcy is will be discussed, as well as how it can be useful, and the distinctions between chapter 7 and 13. Information concerning what not to do preceding and during your bankruptcy case will also be explained, along with a “life after bankruptcy” session.

Blick Law Firm understands that filing for bankruptcy can be very intimidating and stressful. Our goal is to not only educate but to also equip the community with a strong knowledge base of the bankruptcy process. Filling for bankruptcy is common in the state of Florida, and can safeguard and provide comfort for those overwhelmed with debt. What Bankruptcy laws do is liquidate assets, so that debts can be paid. Repayment plans are also available to those struggling with debt, in order to support a new financial beginning.

What is bankruptcy?

Bankruptcy is a legal degree of a person or business that is unable to pay their debt to  creditors. Bankruptcy is appointed by a court order that is generally proposed by the debtor. Filling for Bankruptcy is common in the state of Florida, and can safeguard and provide comfort for those overwhelmed with debt. What Bankruptcy laws do is liquidate assets, so that debts can be paid. Repayment plans are also made in order for those in debt to have a new financial beginning. Bankruptcy cases are generally filed under Chapter 7 or Chapter 13 of the Bankruptcy Code.

creditors. Bankruptcy is appointed by a court order that is generally proposed by the debtor. Filling for Bankruptcy is common in the state of Florida, and can safeguard and provide comfort for those overwhelmed with debt. What Bankruptcy laws do is liquidate assets, so that debts can be paid. Repayment plans are also made in order for those in debt to have a new financial beginning. Bankruptcy cases are generally filed under Chapter 7 or Chapter 13 of the Bankruptcy Code.

It is very important that the information and paperwork are filed correctly to ensure that your bankruptcy claim is successful. The experienced attorneys at Blick Law Firm can assist with your bankruptcy claim, and help to make sure that the proper steps and precautions are being made when filing.

It is very important that the information and paperwork are filed correctly to ensure that your bankruptcy claim is successful. The experienced attorneys at Blick Law Firm can assist with your bankruptcy claim, and help to make sure that the proper steps and precautions are being made when filing.

If you or a loved one is thinking about filing for bankruptcy, Blick Law Firm can help you secure the full benefits to which you are entitled, and help to maximize your recovery.

Posted in Bankruptcy, Blog

Leave a comment

Bankruptcy | Celebrities | Financial Hardship

Filing for bankruptcy can be very intimidating. Many Americans facing financial hardship believe bankruptcy is almost impossible to recover from. Some people are reluctant to choose bankruptcy, and may feel embarrassed, alone, or defeated when considering this option. However, filing for bankruptcy can provide a new financial beginning to those overwhelmed with debt, and countless Americans file for Bankruptcy every year. Rock stars, athletes, and even some of today’s millionaires have used bankruptcy to get their finances back on track.

Filing for bankruptcy can be very intimidating. Many Americans facing financial hardship believe bankruptcy is almost impossible to recover from. Some people are reluctant to choose bankruptcy, and may feel embarrassed, alone, or defeated when considering this option. However, filing for bankruptcy can provide a new financial beginning to those overwhelmed with debt, and countless Americans file for Bankruptcy every year. Rock stars, athletes, and even some of today’s millionaires have used bankruptcy to get their finances back on track.

Walt Disney founded the animation company Laugh O Gram, in 1920. When his financial  backers went broke, Disney became overwhelmed with debt and could not afford payroll. Disney was forced to file for bankruptcy and leave the mice infested company behind. One mouse in particular had a lot of personality; Disney named the mouse Mickey and packed his bags for Hollywood. Upon arrival, Disney started a new self-named production company and invented the animated character Mickey Mouse.

backers went broke, Disney became overwhelmed with debt and could not afford payroll. Disney was forced to file for bankruptcy and leave the mice infested company behind. One mouse in particular had a lot of personality; Disney named the mouse Mickey and packed his bags for Hollywood. Upon arrival, Disney started a new self-named production company and invented the animated character Mickey Mouse.

Today, the 100 billion dollar company is one of the largest in the world.

Multi billionaire Donald Trump, has declared bankruptcy four times. Due to some unsuccessful business ventures, Trump had to file for bankruptcy after accumulating billions in debt. Despite these financial hardships, Donald Trump is among the wealthiest  entrepreneurs in the world with an estimated net worth of 2.9 billion dollars.

entrepreneurs in the world with an estimated net worth of 2.9 billion dollars.

Many people have used bankruptcy to help reclaim financial control of their lives. Bankruptcy laws liquidate assets so that debts can be paid, and repayment plans are available in order to secure a positive financial future.

Following the correct procedure is crucial to ensure a successful bankruptcy claim. A bankruptcy attorney can help guide you through the bankruptcy process, and make sure that paperwork is filed appropriately.

If you are struggling with your finances and considering bankruptcy, the experienced lawyers at Blick Law Firm can help you take the right steps towards a new financial beginning. Call Blick Law Firm today for a free consultation.

Posted in Bankruptcy, Blog

Leave a comment